Recently Diligence provided information regarding the Embassy or Consular form Report of Death of a U.S. Citizen Abroad (herein referred to as a “RDCA”). In this article, Diligence expands upon the data from the United States State Department [1] to show the countries where the deaths are being reported and the causes of loss. Note that this form is used to report deaths of U.S. citizens and does not reflect the actual number of deaths of U.S. insureds who have died overseas. The State Department also only provides details on non-natural deaths.

In 2019, a total of 649 “non-natural” death claims of United States citizens were reported representing 117 countries, and 194 deaths were reported in 2020 through June 30 [2] representing 51 countries (See Appendix 1 for a list of all countries and time periods reported). The country with the highest concentration of deaths was Mexico which, unfortunately, is also known to be a country where there is significant death claim fraud.

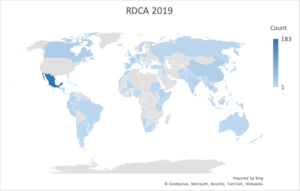

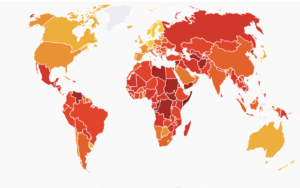

Only 15 of the countries submitted ten or more RDCAs in 2019. In 2019, forty-one countries only reported one death. One of the points raised in Diligence’s previous article on the RDCA is that the embassies who prepare the RDCAs do not see many deaths in a year hence cannot be expected to be experts in identifying death claim fraud (assuming this was in their interest which it is not). Interestingly, some of the top countries are not typically considered places frequently traveled by tourists such as El Salvador, Vietnam, and Ecuador. Exhibit 1 shows the locations of all claims globally, and Table 1 shows the countries with the most deaths in 2019 and 2020.

Exhibit 1

Table 1 – Top 15 Countries reporting Deaths of U.S. citizens

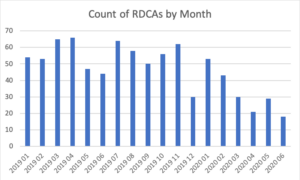

COVID-19 and the associated travel restrictions have had an impact on the claims reported in 2020. There are fewer claims reported in 2020, and since March, 36% of the 98 cases reported have been in Mexico. The second most prevalent location is Thailand with 5% of the reported deaths.

Count of RDCAs from 1/2019 – 6/2020

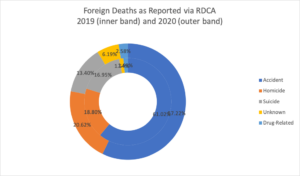

More telling than the location of the reported death is the reported manner of death. Manner of death varies significantly by country. Of the non-natural deaths, accidents were the strongest manner of death followed by homicides and suicides. Determining the manner of death can be difficult even for United States investigators, particularly when it involves violent deaths. We know from experience that murderers will often attempt to disguise the death as a natural death, an accident or suicide to avoid investigations and prosecution.

Exhibit 2

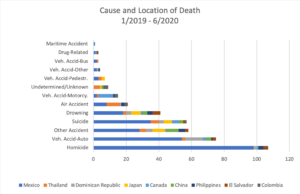

Accidental deaths came in many forms, but the significant portion reported was from automobile accidents, followed by “other” which is not defined, and then drownings. The manner of death varies by country. Homicide was the manner of death in 39% of the cases in Mexico, yet 0% in China, Japan, and the Philippines. Air accidents accounted for 47% of the deaths in Canada (3 accidents) and 80% of the deaths in Ethiopia (1 accident). While most countries had less than 10% of deaths reported as undetermined, Colombia reported one third of their cases as undetermined. The major non-natural manner of deaths in Japan were suicides (36%) and drownings (27%); the major non-natural manner of deaths in the Philippines were suicide (27%), drowning (20%), and homicide (20%).

Causes of death – Select Countries

Some of the common death claim fraud schemes include:

- Using an imposter to take out coverage on someone who was never in the U.S. and then reporting them as deceased,

- Faking the insured’s death,

- Finding a dead body and claiming it as the insured,

- Creating a synthetic or non-existing person who takes out coverage and eventually dies overseas,

- Actually killing an insured to collect the insurance proceeds,

There are many variations of the fraud schemes used, and in some instances, we have found that the insured was not part of the fraud and not even aware a claim had been filed on their life.

The reasons why fraud schemers often use the backdrop of a foreign death are too numerous for this article and will be explored in subsequent articles. However, as an example, in many parts of the world, it is easy to find unclaimed bodies to claim as an insured. It is also not unusual to see local authorities complacent or even participants in fraud schemes. This makes validating deaths, or even applications for coverage on insureds associated in foreign regions, important in protecting companies and shareholders against the expense of fraud.

In Mexico, the major causes were homicide (39%) and vehicular accidents (21%). One of the fraud schemes we have historically seen in Mexico is to take a body who is purportedly an insured, place it in a car, and then stage an accident in a remote location. During the accident, the body is severely battered and burned. To make the victim harder to identify, the legs would often be broken to help mask the true height of the victim. In this fraud scheme, the body is rarely identified, but the insured is found living elsewhere.

The website Transparency.org produces what it calls the “Corruption Perceptions Index” which shows the regions of the world and their relative perceived corruption prevalence. While this is not specific to insurance, it is nonetheless an interesting gage of the perceived corruption in the various countries.

Transparency.org/en/cpi/2019/results

Some of the myths with foreign death claims:

Myth: We have official documents that have been properly registered with the local authority, so we do not need to investigate. This is a myth as was illustrated in the case example in our last article. In many places throughout the world, the controls on official documents are lacking. In addition, the local authorities may not have investigated the death or may even be complacent in the fraud scheme.

Myth: Foreign death claims can be investigated, and fraud detected using telephone calls. This is a partial myth. While the use of telephone investigations may detect some fraud, it is inefficient (albeit inexpensive) since most fraudulent death claims appear legitimate. These investigations touch the tip of the proverbial iceberg with many fraudulent claims remaining undetected. Diligence has uncovered fraudulent claims on many occasions that were paid by other insurers who used telephonic investigations to “validate” the claim.

Myth: The policy is over five years old, surely it is not fraudulent. This is a myth. People’s circumstances and motives change. A policy that was once taken out for legitimate purposes may be viewed as something to exploit years later. We have seen fraud committed on policies over fifteen years old, so policy duration is not a good indicator of whether the death is legitimate

Myth: the insured is old hence we don’t need to investigate it. This is a myth. The age of the insured doesn’t necessarily mean the claim is legitimate. The insured may be alive and well, and not even aware a claim has been filed. It could be family members or others are looking to take advantage of the policy, and are counting on the insurance company not to investigate.

Myth: it is a small amount, so I don’t need to worry about it. This is a myth. While there is a point where it may be difficult to justify the expense of a small claim, it is nonetheless important to validate the deaths. We have experienced cases where the small cases were used as trial runs to see what would happen. If they are paid without confirmation, the insurer may be setting themselves up for many more claims that are similar. Don’t be fooled into thinking that fraudsters are not watching the processes followed by individual companies. They are, and they will exploit any perceived weaknesses.

Knowing the types of fraud schemes prevalent in the various regions gives an experienced investigator an advantage. At Diligence, we have conducted literally thousands of investigations outside of the United States in the same period that the embassies reported approximately 850 non-natural deaths [3]. We are experts in the customs, cultures, and practices of regions globally, and we have dedicated professionals that have been vetted and retained exclusively for Diligence. Whether it be investigating foreign deaths or verifying a case for underwriting, we have experts ready and eager to assist you.

Do you have an interesting foreign case story you would like to share or a pending case that needs some attention? Please reach out to Kevin Glasgow or Erick Soeth at Diligence – we would like to hear from you.

————

[1];https://travel.state.gov/conte…

[2] All references to 2020 data refer to data through June 30, 2020 which is the most current data available as of this article.

[3] Deaths reported as natural are just as susceptible to being fraudulent and should be investigated just as non-natural deaths should be confirmed. Unfortunately, the State Department does not report the number of natural deaths.