Are you up-to-date on mitigating fraud attempts in Living Benefit claims?

Living benefit policies provide much needed protection to markets considered vastly underserved. Long term care (LTC) benefits and disability claims incurred in 2018 were $11.9 billion and $19.3 billion, respectively, based on the latest figures published by the ACLI.[1] Another $62.8 billion was paid in Worker’s Compensation benefits.[2]

These claims are some of the most challenging to adjudicate due to the complexity of the policies and riders and subjective nature of some claims, coupled with the relative ease of symptom magnification, occupational exaggeration, and pure fraud. And for reasons discussed below, COVID is adding to the risk and complexity of properly evaluating these claims. As reported by the Association of Certified Fraud Examiners, it is widely believed that the global pandemic will create the perfect storm for fraud.[3]

Because of these challenges and others, the claims manager must be diligent in reviewing living benefit claims thoroughly, consistently, and fairly or risk accepting an invalid claim exposing the company to unnecessary liabilities. Often, evaluations require collaboration with outside resources to reach proper claim decisions and protect against unwarranted payments. Keeping abreast of trends, schemes, and tactics used by illicit actors has never been more important, particularly in an environment that is changing, as we have all seen in 2020. Illicit actors can be individuals, but they can also be part of sophisticated, organized crime rings.

Elements of Fraud

Dr. Donald R. Cressey, a well-known criminologist, proposed in the 1950’s that there were three major elements necessary for fraud to occur: motivation or pressure, perceived opportunity, and rationalization. When it comes to rationalization, the unfortunate fact is that many people do not see the harm in taking from an insurance company if the opportunity presents itself. That leaves the other two elements to consider, particularly in light of COVID-19: – motivation and opportunity.

Motivation

We know economic hardships will increase pressure on people to seek alternative sources of income such as through insurance fraud. Many people have lost jobs as unemployment soared to nearly 15% in the United States due to COVID-19. In the era of COVID-19, economic hardships may take many forms including:

- lost jobs or reduced pay,

- having to stay at home to take are of home-bound children, or

- having to care for elderly parents at home in lieu of the isolation of senior / assisted living centers, not to mention the risk of a potential fatal outbreak in such a center.

As individuals struggle with the economic impacts from COVID-19, people typically considered low risk for fraudulent behavior may bend to the pressure.

Of course, there are always those that did not need COVID-19 to motivate them to game the insurance industry. For organized, systemic fraudsters, the motivation was present prior to COVID-19, and these players are simply looking for the perceived opportunity to profit from their illicit activities.

Opportunity

Two converging factors are increasing the opportunity for fraud amongst living benefits insureds. One is COVID-19, and the other is the already-present move by the industry toward a more digital, automated process that place an increasing reliance on data analytics and technology in lieu of human oversight and review. Data analytics can certainly be an important tool to use, but like all tools, its application has limitations.

COVID-19 has created an environment where investigating claims has become more challenging due to more restricted access to the tools usually used to evaluate claims such as:

- Obtaining medical records and claim forms from physicians are more difficult due to fewer office hours and or reduced staff in physician offices.

- Doctors have increased the use of tele-medicine. While tele-medicine has been a significant positive step forward in many ways, it does not allow the physician to fully observe and make clinical observations.

- Insureds are hesitant to visit doctors except in emergencies.

- Fewer in-person interviews are being conducted which can be critical to validating a claim – or finding the illicit actors. Balancing this is the increase in video conferences which would have been unthinkable prior to COVID-19 and are better than telephone calls. Video conferences will allow the interviewer to observe expressions, but much is still lost such as observing the movement of the insured and observing the insured’s environment. Also lost with video conference is the spontaneity of a telephone call thus allowing the claimant time to rehearse and prepare answers to anticipated questions.

- Surveillance has become more complicated due to lock-downs, restrictions, and frankly, more people at home to spot would be surveyors. Further, the advent of new technology like the Ring doorbell and applications like Neighbors and Nextdoor have created additional constraints on discreet surveillance deployment. It is often not the claimant who identifies a surveillance vehicle, it is a neighbor who alerts others nearby through these apps to the presence of an unknown vehicle.

- IME’s and FCEs are more difficult to schedule as providers reduce all but essential services, and insureds may resist citing fear, whether real or an excuse, of contracting COVID-19.

- Disputed claims are more difficult to litigate because court systems are backlogged.

Illicit actors have and will exploit these challenges to skirt requirements and confound claim examiners. They can do this by simply seeking to get requirements waived under the pretense of not being able to meet the requirements in the new environment when in reality, they may not meet the requirements for benefit eligibility. It may be difficult to detect the illicit actors from the legitimate ones without diligent investigations.

In addition, the work environment for claim staff members has significantly changed. While some may welcome working at home, for others, it is presenting new stresses and challenges. As someone described it, parents are now expected to hold a job, be the cook, the maid, the teacher for children, and the daycare provider. Working from home and the lockdowns are adding stress to many people that already have demanding jobs as evidenced by counselors reporting more mental health and domestic issues. This creates opportunity for less focus on detecting fraud, errors and gaps that can be exploited by illicit actors.

Social Security Disability

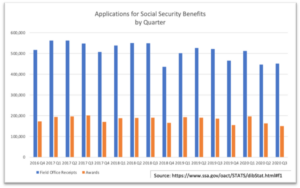

Traditional wisdom holds that macro-level economic woes will trigger increased filings for disability benefits as people seek alternative sources of income. However, we have seen times when this was not the case, and this may be one of those times. In looking at number of disability claims filed with the Social Security Administration, the number of cases filed has not increased. Note that eligibility under SSDI requires the participant to be permanently disabled whereas most group and individual plans do not. While we will not know the true impact on disability plans until 2021, most are expecting an increase in COVID-19 related claims including mental health claims resulting from the affects and stress of COVID-19. On the positive side, we are likely to see fewer workplace injury claims being filed.

Investigating Accelerated Benefits

Accelerated benefits and waiver of premium claims are not immune to fraudulent activity. Accelerated benefits may be triggered based on diagnosis (critical illness), prognosis (terminal illness), or limitations (chronic illness). Although payment of these benefits may not be as high as traditional living benefit policies, there is still a need to validate the claims to insure the benefit triggers are met and valid. We have seen fraudulent activity on these benefits as well.

When to Investigate

One of the best defenses to protect against fraud is to keep it off the books at time of application. That said, insureds who purchase insurance for legitimate purposes may turn to filing fraudulent claims as their situations change, such as with the current environment. Once on the books and a claim is filed, investigations are critical to make sure the claims filed are legitimate. Investigations can take many forms from evaluating forms submitted and phone calls all the way to surveillance and litigation depending on the facts and circumstances of a claim.

The best time to investigate a claim is at onset. Every new claim should be evaluated thoroughly to make sure the motivations for filing are genuine and the insured meets the benefit triggers. Conducting investigations early, before malingering sets in, before the insured becomes tainted about returning to work, or other secondary motivators become established, can provide a priceless baseline for future reference. It has been our experience that occupational duties given early at the onset of the claim may be much more accurate and different that the duties recanted years into the claim. Some of the obvious baseline information is occupational duties and requirements, sources of income (particularly with doctors and lawyers who may claim high levels of income from specfic services such as surgeries or trials), medical conditions and physical limitations. Another to consider is emotional health and desire of the claimant to return to work. In LTC, ensure the diagnoses are consistent with the restrictions in activities of daily living being claimed, verify the care provider is eligible and for home care, establish if a personal relationship exists between the insured and caregiver.

After a claim has been approved, there are key points in which further reviews should be conducted depending on the diagnosis and prognosis. Staying in close contact with the insured from the early months through the first year often provides valuable insight into the insured’s motivations and progress. Beyond that, key points of time to investigate include a) four to six months prior to a change in definition of benefit eligibility, b) when the insured’s disability seems to be morphing into a different diagnosis and limitation, c) when the insured’s disability appears to be extending beyond the anticipated recovery date, d) when the insured may benefit from rehabilitation or occupational therapy, and d) any time that the insured’s activity is inconsistent with the limitations given.

Tools and Mitigants to Fraud

As we encounter these new challenges presented in our environment, there are mitigants that can and should be employed. New and changing environments will undoubtedly create new schemes, and with that, companies must be ever diligent to develop new techniques to prevent, detect, and combat the illicit acts. Tools include but are not limited to cyber investigations, digital data collection and data augmentation, traditional data collection and reviews, surveillance, and human intelligence and expertise.

As so many consumers are now working from home, we have encountered higher rates of online postings including social media activity and information derived from other online forums. We have encountered claimants who have not been active on social media historically, but since COVID-19, have increased their social media postings and activity significantly. There are also other data points that have come into being such as the public dissemination of the PPP loan data. Through this, we have identified numerous “disabled” business owners’ businesses who have received government loans predicated on the ability to work but for COVID-19.

Criminal record searches are a critical investigative tool utilized when developing the background information for a claimant. Civil record searches are equally as important and may contain information not available in a typical criminal record review. Civil cases often contain affidavits and sworn statements that can be cross referenced to the information provided by the claimant in order to confirm statements made or expose discrepancies or omissions. Divorce decrees or other domestic or business disputes may reveal key facts that contradict the information being claimed. These records may also contain information suggesting a motive to commit fraud.

Case Example: during an investigation involving numerous fraudulent LTC payments for home care services that had never been provided, several seemingly unrelated claimants were identified and surveilled. In an attempt to locate the common denominator amongst the fraudsters, a background investigation was conducted. A civil record was eventually located at a local court documenting a name change for one of the claimants. Once the claimant’s prior name was identified, we were able to conduct additional research which revealed the claimant had previously worked as a physician and had personally signed the attending physician statements for the other fraudsters on claim.

Interviews continue to be a key element in collecting data from employers, insureds, and medical providers. In-person interviews yield the best results since most of what is communicated in speech go beyond the words spoken. Other clues such as gestures, tones, and facial expressions make up the majority of what is actually communicated. Also, the interviewer can observe the environment for supporting clues to the insured’s activities and health, such as how the insured ambulates, oxygen concentrators, prescription drugs or ambulatory equipment. Additionally, the element of surprise is lost when conducting prescheduled video interviews, allowing fraudsters or malingerers to prepare or anticipate probing from a skilled investigator In today’s world, most people of working age have become use to videoconferencing tools such as Zoom and Skype, which help but are not as good as in-person encounters. Still, with a skilled interviewer, valuable information can be obtained. We continue to recommend interviews, and in particular, in-person interviews where possible, and if not possible then interviews by videoconference.

Video Surveillance Techniques and Challenges

Conducting surveillance was initially worrisome during the initial lockdown phase. Techniques have been adapted, and we continue to uncover a high level of fraud through sub rosa as suspect claimants have become more active. Investigators can now resume covert surveillance activities and can easily blend in while utilizing face coverings and adhering to social distancing guidelines. In other instances, investigators remain safe from infection while conducting most activities from their vehicles or through unmanned surveillance.

Successful video surveillance often involves a combination of unmanned and manned video surveillance techniques optimized for varying geographies and urbanization. Much of the industry has shifted to unmanned surveillance techniques which can be highly effective in certain circumstances. Having small and virtually undetectable video surveillance equipment available 24 / 7 is a great advantage for investigations. Examples of some if the small and almost undetectable equipment we use include the following:

As important as these are, they have their place and need to be deployed appropriately. There are numerous shortfalls in urban settings where a drop cam is simply not feasible. Also, using just unmanned video surveillance has the propensity to miss activity when a claimant departs from his or her residence. Manned surveillance can follow the claimant to the activities outside the home. This is where a combination of techniques and tools is critical to a successful surveillance that will not only show activities but hold up in a legal challenge.

What to do after fraud is identified?

A common challenge we’ve observed when fraudulent activity has been clearly identified is determining the final steps needed to remedy the problem claim. Proper claim documentation throughout the claim is imperative. The claim file tells a story, and that story may need to be told in front of a jury. An improperly documented file such as one that is incomplete or contains superfluous and unflattering opinions can tell the wrong story. Likewise, the investigation reports need to be substantial, factual, and accurate. There’s an old plaintiff’s adage that says, “when the facts are on your side, argue the facts, otherwise argue against the process, and if that isn’t going to win the case, appeal to the emotional aspects of the case.” Diligence must be taken in handling all aspects of the claim, the claim investigation, and in reaching the decision.

Collecting sufficient evidence is important before the claim is denied. If a claimant challenges the denial, it is much more difficult to conduct surveillance or gather data when the claimant may be aware or suspecting potential investigation. If a claim is heading toward denial, we advise that the denial does not mention the investigative measures taken as this will eliminate chances for success in the event additional investigation is required. It is common knowledge that plaintiff attorneys can coach claimants and will frequently warn them of investigation tactics including to be alert to the possibility of surveillance.

Best Practices

- Evaluating a claim at onset is critical. Gather as many relevant facts as possible early and assume the claimant will stay on claim. If it is a legitimate claim, the information will serve as a baseline for future comparisons and statements. It may also uncover an unwarranted claim.

- Often, the eligibility for benefits change at a pre-determined time such as after two years. Investigating claims that have a change in definition should begin four to six months prior to the change since collecting information and reaching a decision may take time.

- Evaluating the motives of the insured is important. Understanding this may help get the insured to return to work quicker, or it may also uncover someone who is fraudulently claiming benefits.

- Implement a strong fraud training and awareness program to ensure claim staff and/or third party administrators are adequately trained to identify fraudulent activity.

- Develop a comprehensive list of red flags that can be disseminated amongst the claim staff for easy reference.

- When conducting surveillance, eliminate the good day/bad day defense by extending the duration of the surveillance and breaking the surveillance up over several weeks or months

- Gather as much evidence as possible before denying a claim. Once a claim is denied, claimants engaging in fraud may change their behavior and/or scrub their online data in anticipation to suspected investigation.

- If fraud is discovered, it is best to void the policy if possible instead allowing the claimant to go off claim but to keep the policy. Many sophisticated fraudsters have agreed to go off claim, only to refile a new fraudulent claim shortly thereafter.

Diligence in investigations

Living benefits are challenging, and more than ever, they require diligence in evaluating. 2020 has brought new challenges exacerbated by increased pressure on insureds, staff members and potential opportunities for fraud. While we cannot control the pressure, we can control the opportunity. Proper evaluation and investigation of claims must be done early and at multiple points within the life of the claim using the latest tools and techniques. Insuring a proper decision at the onset of a claim followed by active case management can mean the difference in paying lifelong benefits or helping someone back to work. Once an incorrectly approved claim starts, it becomes increasingly more difficult and costly to correct the error and close the claim.

Diligence has experienced and dedicated staff passionate about finding the truth. Our staff and network of experts are not only skilled in investigations and fraud detection, but understand the nuances and complexities of living benefits. We utilize a myriad of tools including but not limited to:

- A proprietary data analytics screening tool designed for IDI, WP, and Group LTD claims to “score” claims based on claimant motivation and risk of not returning to work.

- State of the art surveillance.

- Cyber reviews and analysis.

- Skilled and tailored interviewing of claimants, employers, law enforcement, and other key parties.

- Data augmentation.

- Coordination of IMEs, peer reviews, and forensic accounting

- Records retrievals including medical, pharmacy, criminal, law enforcement, etc.

- Medical and pharmacy canvassing.

Regardless of the stage of the claim, Diligence International Group is here to assist with your data collection and evaluation needs. We would like to partner with you, and for more information, please contact Paul Marquez at Paul.Marquez@DIGroup-US.com or 800-660-4202; or Kevin Glasgow at Kevin.Glasgow@DIGroup-US.com or (972)-301-8454. Also, visit our website for more information about Diligence at www.DIGroup-US.com.

Paul Marquez Kevin Glasgow

—

[1] ACLI 2019 Life Insurers Fact Book: https://www.acli.com/-/media/ACLI/Files/Fact-Books-Public/09FB19FChap9DILTC.ashx?la=en

[2] https://www.nasi.org/research/2020/executive-summary-workers%E2%80%99-compensation-benefits-costs

[3] Coronavirus Pandemic Is a Perfect Storm for Fraud: https://www.acfe.com/press-release.aspx?id=4295010491